refinance transfer taxes florida

When interest rates drop consider refinancing to shorten the term of your mortgage and pay significantly. The Florida Retirement System FRS offers two retirement plans for state employees.

Transfer Tax Alameda County California Who Pays What

Deed In Lieu Agreement.

. In Florida taxes are due once a year and there is a discount if taxes are paid by November 1 so your lender or servicer will assume you want to pay your taxes by that date. There are several ways to transfer real estate title. In 2019 according.

The most common is the quitclaim deed but some parents opt for a transfer on death deed which comes into effect after you pass away. A warranty real estate deed transfer is the most common type of deed used when properly is sold to a third party in a typical real estate transaction. Your bill will be 3200.

How long it will take to get a stimulus check after filing. Yes you can legally transfer the deed to your house to your kids before you die. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based.

To do this youll need to sign a deed transfer and record it with the county recorders office. Real estate transfer taxes are considered part of. The comptrollers office will charge you a small fee for the recording.

Say you owe the government 5000 but are due 1800 in EIPs. A deed in lieu means you and your lender reach a mutual understanding that youre no longer able to make your mortgage loan payments. The comptrollers office records the deed into the countys official records.

As far as inherited retirement accounts are concerned the heirs of such finances must pay income tax on the assets they withdraw. Retirement accounts payable-on-death bank accounts life insurance policies transfer-on-death accounts. Friendly Advice For Personal Loans Auto Loans Mortgage Debt Credit Refinance Tax Relief Insurance and More.

Florida is one of the few states that does not collect income taxes. Your taxes are 3600 a year and your homeowners insurance is 600 a year. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

Jointly-owned bank accounts or homes. For example a 30-year fixed-rate loan has a term of 30 years. Super Power Your Money.

A warranty deed promises that the person transferring the property has good title to it and the right to sell it. Getting a mortgage with a lower interest rate is one of the best reasons to refinance. Other things to know about Florida state taxes.

It includes protections for. Other Situations in Florida Inheritance Laws. The rules of real estate transfer taxes vary by location.

Lets examine their differences below. A deed in lieu and a foreclosure arent the same. The Recovery Rebate Credit may also impact your state taxes according to The New York Times.

You are refinancing your existing loan. First lets look at a refinance example. However its state and local tax burden of 89 percent ranks it 34th nationally.

A pension plan for long-term workers and a defined contribution plan for shorter-service workers or people who do not plan on working for the state for more than six years. If youre on the hook to pay taxes the IRS will reduce your bill by the amount of your stimulus checks. The FRS also oversees the retirement plans for state university and community colleges and for.

The lender agrees to avoid putting you into foreclosure when you hand the property over amicably. However expect a larger fee and transfer taxes if there is a mortgage on the property. As a result Florida had the eighth-lowest tax burden defined as the state and local taxes a resident pays divided by the states share of net national product in the US.

The Loan term is the period of time during which a loan must be repaid. The state of New Jersey requires you to pay taxes if you are a resident or nonresident that receives income from a New Jersey source.

What You Should Know About Santa Clara County Transfer Tax

What Are Real Estate Transfer Taxes Forbes Advisor

Georgia Real Estate Transfer Taxes An In Depth Guide

Texas Real Estate Transfer Taxes An In Depth Guide

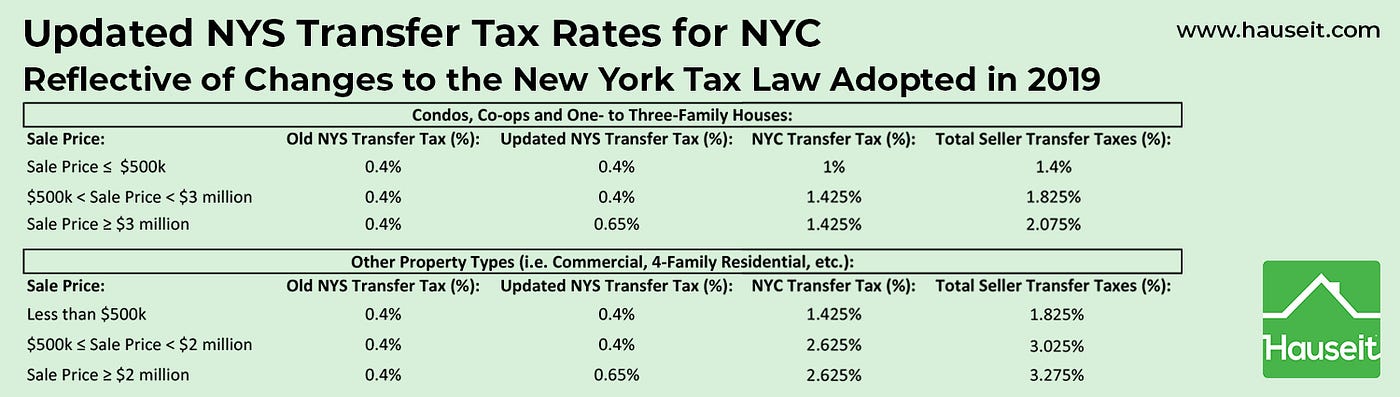

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Closing Costs For Home Buyers And Sellers Your Realtor For Generations Cheryl Facione Crs Gr Real Estate Tips Real Estate Infographic Real Estate Investing

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Ever Wonder Who Pays What Fees In An Real Estate Closing Getting Into Real Estate Real Estate Exam Title Insurance

Tennessee Real Estate Transfer Taxes An In Depth Guide

What You Should Know About Contra Costa County Transfer Tax

Transfer Tax Calculator 2022 For All 50 States

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

/writing-hand-pen-money-office-math-699519-pxhere.com1-689d978232b349a0b997494f7d98728a.jpg)